Japan's Rural Transformation to Chip Cities

Japan is embarking on a transformative journey to reclaim its prominence in the global semiconductor industry. The country is investing billions to transform its low-population rural towns into thriving chip cities, aiming to revitalize these areas while strengthening its position in the tech sector.

Rapidus and TSMC Projects

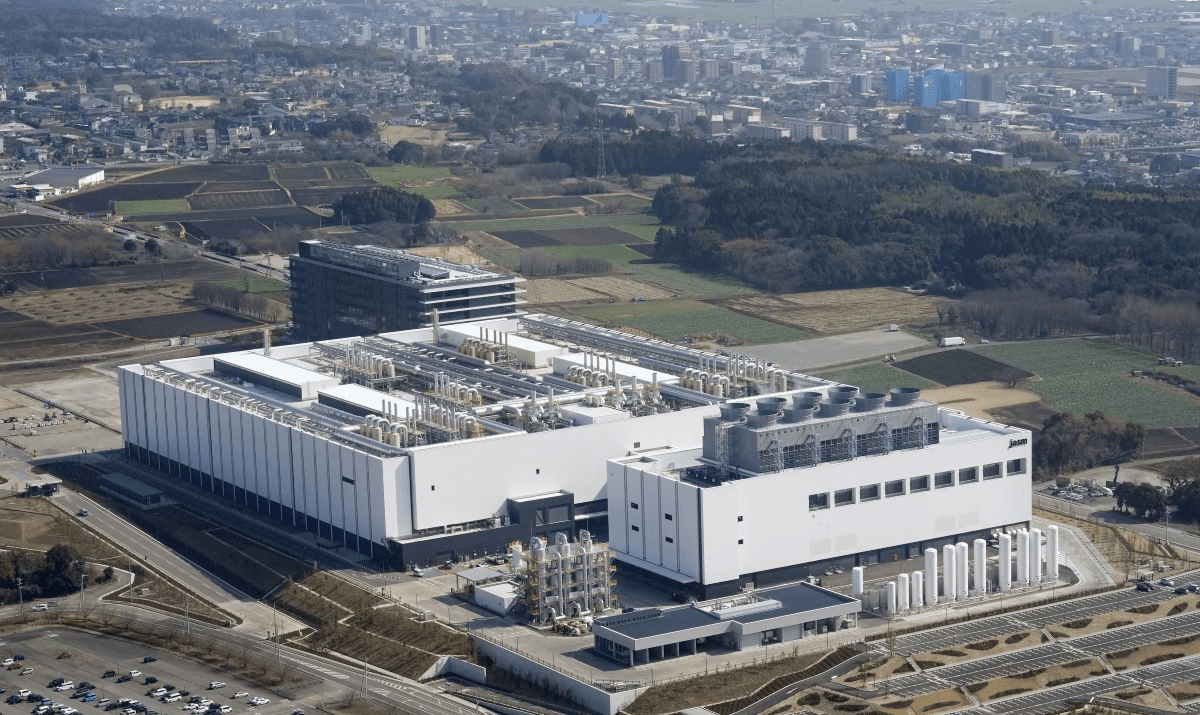

Rapidus and TSMC are spearheading Japan's semiconductor resurgence with ambitious projects aimed at advanced chip production. Rapidus is on track to begin 2nm chip trial production in April 2025, with commercial development expected by 202712. The company has installed ASML's cutting-edge EUV lithography machines at its Innovative Integration for Manufacturing (IIM-1) facility in Chitose, Hokkaido3. Meanwhile, TSMC has commenced mass production at its first Kumamoto fab in late 2024, focusing on 12/16nm and 22/28nm process technologies4. TSMC plans to start construction of a second fab in Kumamoto in Q1 2025, targeting operations by 202745. These projects represent significant investments, with Rapidus seeking additional funding of ¥100 billion ($699 million) for its 2nm fab6, and TSMC's total investment in Kumamoto expected to exceed $20 billion4.

Water: Chip Industry's Lifeline

The semiconductor industry's expansion in Japan, particularly in Kumamoto and Hokkaido, faces significant water resource challenges. Semiconductor manufacturing is extremely water-intensive, with a typical plant consuming millions of liters daily for processes such as wafer cleaning and cooling systems12. This high demand puts pressure on local water supplies, especially in areas like Kumamoto, known for its groundwater resources34.

To address these challenges, companies are implementing water conservation strategies:

TSMC's new facility in Kumamoto aims to reclaim about 65% of its water usage5.

Advanced water treatment technologies, including wastewater recycling and closed-loop systems, are being adopted to reduce freshwater consumption67.

Manufacturers are optimizing production processes to minimize water usage and improve efficiency6.

There's a growing focus on sustainable water management practices, which not only conserve resources but also offer cost savings and operational efficiencies8.

However, concerns remain about the long-term sustainability of water resources, particularly as chip production expands and becomes more complex, potentially increasing water demand

Economic Ripple Effects

Japan's renewed focus on semiconductor manufacturing is poised to have a significant economic impact. The government expects its investment of 3.9 trillion yen (€23.17 billion, $24.8 billion) between fiscal years 2021 and 2023 to yield substantial returns, projecting an economic impact of around $1.04 trillion12. This investment, accounting for 0.71% of Japan's GDP, surpasses the proportional investments of countries like Germany (0.41%), the US (0.21%), and France (0.20%)1.

The semiconductor industry's revival is expected to create numerous job opportunities and boost regional economies. In Kyushu, where TSMC has established a chip plant, and in Hokkaido, where Rapidus is developing advanced facilities, job openings for chip engineers have surged3. The industry's strong economic multipliers suggest that every new semiconductor job could sustain over five new jobs in other industries4. Additionally, the government aims to increase domestic semiconductor-related sales to over 15 trillion yen (approximately $99.4 billion) by 2030, tripling the level5.

Rural Tech Transformation

Japan's semiconductor revival is transforming rural landscapes, with former agricultural areas now hosting cutting-edge chip facilities. In Chitose, Hokkaido, Rapidus is constructing a state-of-the-art plant on land once dedicated to rice cultivation1. This shift symbolizes Japan's commitment to technological advancement and economic revitalization.

The transition from agriculture to high-tech manufacturing brings both opportunities and challenges:

Job creation: The semiconductor industry is expected to generate thousands of high-skilled positions, attracting talent to previously underdeveloped areas2.

Infrastructure development: Regions hosting chip facilities are seeing rapid improvements in transportation, energy, and digital infrastructure3.

Environmental considerations: While chip production is water-intensive, companies are implementing advanced water recycling systems to minimize impact on local resources4.

Cultural shift: Traditional farming communities are adapting to the influx of tech workers and the changing economic landscape3.

This transformation reflects Japan's broader strategy to reclaim its position in the global semiconductor market while addressing regional development challenges56.

I originally published this article on Perplexity with 65k views